Such payment made on behalf of the employee is considered as a perquisite to the employee and is treated as gross income from employment under Section 13 1 a of the Malaysian Income Tax Act 1967. B an amount equal to the value of the use or enjoyment by the employee of any benefit or amenity not being a benefit or amenity convertible into money provided for the employee by or on behalf of his employer excluding.

Basis period to which gross income from an employment is related.

. Income Tax Act Part. Income Tax 13 Chapter 1ARuling Section 138 A. All perquisites are gross income under paragraph 131a of the ITA 1967 and are chargeable to tax under subsection 4b of the ITA 1967.

Power to substitute the price on certain transactions 140. Free Hotel Accommodation In accordance with tax treatment Michelle is liable under Section 13 1 c of ITA 1967 which requires her to pay taxes for hotel accommodation provided by her current employer. Section 121a serves as a residual section to tax whatever gross income that is not attributable to operations of business carried on outside Malaysia would be deemed Malaysian derived income.

1 Subject to this section income tax charged for each year of assessment upon the chargeable income of a person who gives any loan to a small business shall be rebated by an amount equivalent to two per cent prorated per annum or such other rate as may be prescribed from time to time by the Minister on the outstanding balance of the loan before any set off is made under. As per section 13 1 bany income of the trust or institution established on or. Taxable in the year of receipt 12000.

Provisions of section 13 1 a dont apply in case the benefit is ensured for a large number of people but the control is with a specified group of a person as it doesnt matter where the control lies. Perquisites have the following characteristics. 52 All perquisites are gross income under paragraph 131a of the ITA and are chargeable to tax under section 4b of the ITA.

A Expenses on repairs and renewals that are deductible under Subsection 331c of the Income Tax Act 1967 the ITA b Categories of repair expenses i Repair to restore assets to their original condition ii Initial repairs c Replacement of entirety entire asset vs part of the entirety d Replacement vs improvement. The amount of employment income declarable is calculated as follows. And b thereafter where the members funds of such co-operative society as at the first day of the basis period for the year of assessment is less than seven hundred and fifty thousand ringgit.

If the taxpayer receives more than one pension the exemption will be on the highest pension received. Perquisites are taxable under section 4b of the ITA as part of the gross income from employment under. Perquisites received can be in cash or in kind.

If it is received in. 1 Gross income of an employee in respect of gains or profits from an employment includes. Power to disregard certain transactions 140 A.

B an amount equal to the value of the use or enjoyment by the employee of any benefit or amenity not being a benefit or amenity convertible into money. ATXB 213 MALAYSIAN TAXATION I 8 Sec 131a - Perquisite Perquisites are benefits in cash or in kind which can be converted into money received by an employee from his employer or from third parties in respect of having or exercising an employment. The amount of instalment payments or tax deduction made in the name of the individual and the spouse have to be totalled and entered in item F2Form BBE of the spouse on whom the tax is to be raised.

The income of trust established after 01041962. 1 this act may be cited as the income tax act 1967. Perquisites can be received regularly or casually.

For an employee in the public sector who elects for optional retirement his pension will be taxed until he attains the age of 55 or the compulsory age of retirement under any written law. Perquisites have the following characteristics. Paragraph 13 1 b of Schedule 6 of the Income Tax Act 1967 which provides for incomes of religious institutions to be exempted from income tax that was passed by Parliament under the.

Advertisement taxes are inevitable but if you are educated you can. It sets out the interpretation of the director general in section 904 of income tax act. S13 1 a Income Computation Yearly Taxable Amount RM Muthu paid a mthly salary of RM7500 after deducting 11 EPF loan of RM700.

Note that income from equipment leasing does not fall under this exclusion and is subject to seca tax. In malaysia the. Provisions of the income tax assessment act 1997 are identified in normal text.

A any wages salary remuneration leave pay fee commission bonus gratuity perquisite or allowance whether in money or otherwise in respect of having or exercising the employment. 1 Subject to subsection 1A or 2A where gross income from an employment- a is not receivable in respect of any particular periodand b first becomes. Perquisites received can be in cash or in kind.

Income Declared Under Section 13 1 a RM 120000 2. Salary or wages in lieu of notice Compensation for breach of a contract of service Payments to obtain release from a contingent liability employers obligation under a contract of service Ex-gratia or contractual payments redundancy payments severance pay etc made to employees who have become redundant for reasons beyond their control. Advance Pricing Arrangement Chapter 2Controlled companies and powers to protect the revenue in case of certain transactions 139.

Chapter 3 - Gross income Section. Section 138A of the Income Tax Act 1967 provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. 7500 700 x 100 89 x 12 mths 110562 Muthu receives a bonus of RM12000 in the basis yr 2011.

PART III - ASCERTAINMENT OF CHARGEABLE INCOME Chapter. Further the payment is subject to Monthly Tax Deduction MTD when the payment is made to the employee or hisher previous employer. Perquisites can be received regularly or casually.

A in respect of a period of five years commencing from the date of registration of such co-operative society. In the united states every working person who earns more than a certain amount of money each year needs to pay income taxes to the federal government. It sets out the interpretation of the Director General of Inland Revenue.

The scope is wider than merely to treat gross income that is attributable to business operations carried on in Malaysia. All you need to know here. The wife has a total income of RM60000 and elects to be assessed in the name of her husband.

Advance ruling 138 C. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Public ruling 138 B.

Comparehero The Comparehero Guide To Purchasing Property In Malaysia Borneo Post Online

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Covid 19 The Enhanced Wage Subsidy Programme Bdo

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Malaysia Has The World S Highest Deforestation Rate Reveals Google Forest Map

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

House Rental Agreement Format Docxfind This Example Of Simple House Rent Agreement To Rental Agreement Templates Buying A Rental Property Room Rental Agreement

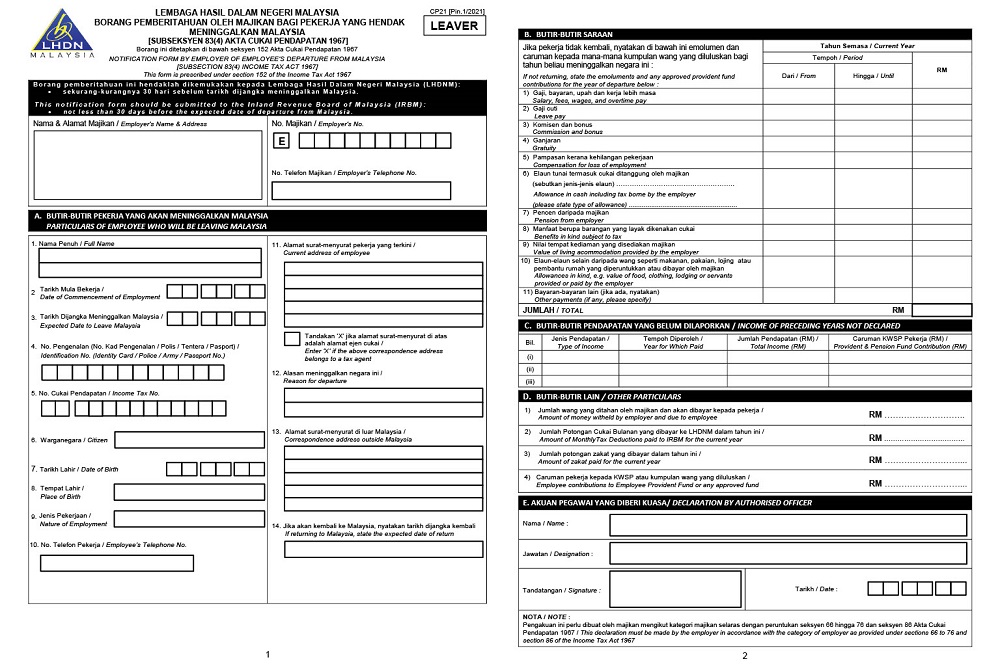

Hr Guide Tax Clearance Letter Form Cp22 And Form Cp22a

How Much Do You Need To Save For Your Children S Higher Education Created In Free Piktochart Infogra Educational Infographic Childrens Education Education

Difference Between Wire Transfer Swift And Ach Automated Clearing House First Time Home Buyers Buying Your First Home Home Financing

Pdf Aiims Rishikesh Holidays List 2022 Pdf Download In 2022 Holiday List Yearly Calendar Academic Calendar